Income Tax Payable in India

Taxes are an inevitable part of life, and income tax plays a crucial role in funding government initiatives. Understanding your income tax payable in India is essential for responsible financial planning and compliance. This guide delves into the concept of income tax payable, equipping you with the knowledge to navigate the tax system confidently.

Unveiling the Calculation Process: A Step-by-Step Approach

Calculating your income tax payable might seem daunting, but it can be broken down into manageable steps:

- Unveiling Your Gross Total Income:The foundation encompasses income from all sources in a financial year. It includes your salary, income from investments like interest on deposits or stock dividends, rental income from properties, and any business profits you might earn.

- Harnessing the Power of Deductions and Exemptions:Fortunately, the Income Tax Act of India offers a helping hand by allowing you to deduct various expenses from your gross income. These deductions reduce your taxable income, ultimately lowering tax liability. Some common deductions include medical expenses, interest paid on home loans, investments in specific retirement schemes or life insurance plans, and educational expenses for your children.

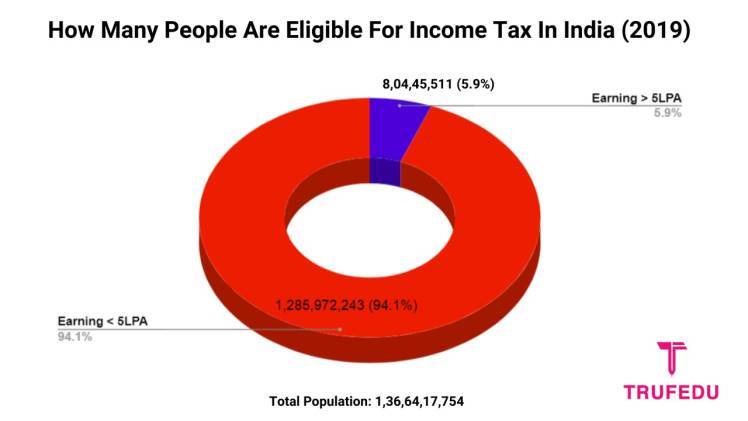

- Navigating the Tax Brackets: Once you have claimed your deductions and exemptions, you’ll arrive at your taxable income. India employs a progressive tax system, where tax rates increase as your income rises. Based on your taxable income, you’ll fall under a specific tax bracket, each with its corresponding tax rate.

- Calculating Your Tax Liability: This is where the rubber meets the road. Multiply your taxable income by the tax rate applicable to your bracket. The result represents the total income tax you would owe before considering any advance tax payments.

- Factoring in Advance Taxes: Throughout the year, you might have already paid some taxes through sources like Tax Deducted at Source (TDS) withheld from your salary or advance tax payments you made directly to the government. These pre-paid taxes can be deducted from your total income tax liability, reducing the final amount you owe.

Income Tax Payable vs. Income Tax Expense: Understanding the Nuances

It’s important to differentiate between income tax payable and income tax expense:

- Income Tax Payable:This refers to the actual amount of tax you owe to the government after considering all deductions and advance taxes paid. It’s a liability reflected on your financial statements (if applicable) and represents your tax obligation for the year.

- Income Tax Expense:This is a concept primarily relevant to businesses. It’s the estimated tax expense a business anticipates incurring for the current accounting period. It appears on the income statement and reflects the cost of doing business related to income taxes.

The Benefits of Understanding Income Tax Payable

Grasping the concept of income tax payable empowers you in several ways:

- Strategic Tax Planning:Knowing your estimated income tax liability allows you to budget for annual tax payments. This helps avoid penalties for late payments and ensures you’re financially prepared to meet your tax obligations.

- Accurate Tax Return Filing:Filing your income tax return requires reporting your annual income tax payable. Understanding income tax calculations ensures you accurately determine and report the correct amount.

- Informed Financial Decisions:When you understand your tax liabilities, you can make informed financial decisions. This might involve maximizing investments that offer tax benefits or claiming all allowable deductions to minimize your overall tax burden.

Additional Resources:

- Income Tax Department of India:https://www.incometax.gov.in/iec/foportal/ -This official website provides comprehensive information on tax brackets, deductions, and tax filing procedures.

- ClearTax:https://cleartax.in/ – This user-friendly platform offers tools to calculate income taxes and understand tax implications in India.

Remember, this is a general overview, and the intricacies of calculating your income tax payable can vary depending on your specific circumstances. Consulting a tax professional can provide personalized guidance and ensure you navigate the tax system effectively. By equipping yourself with knowledge and utilizing available resources, you can fulfill your tax obligations efficiently and confidently.